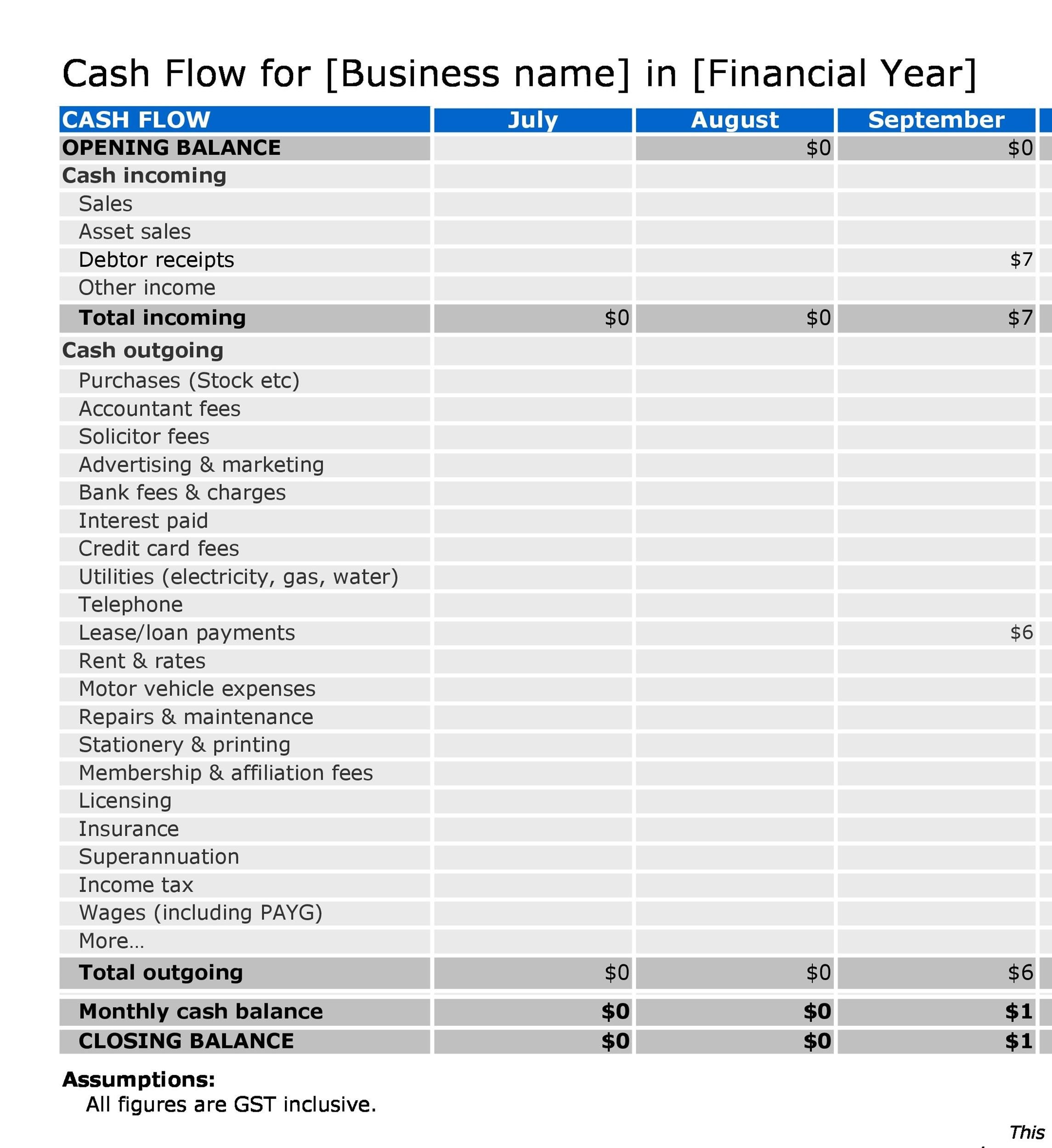

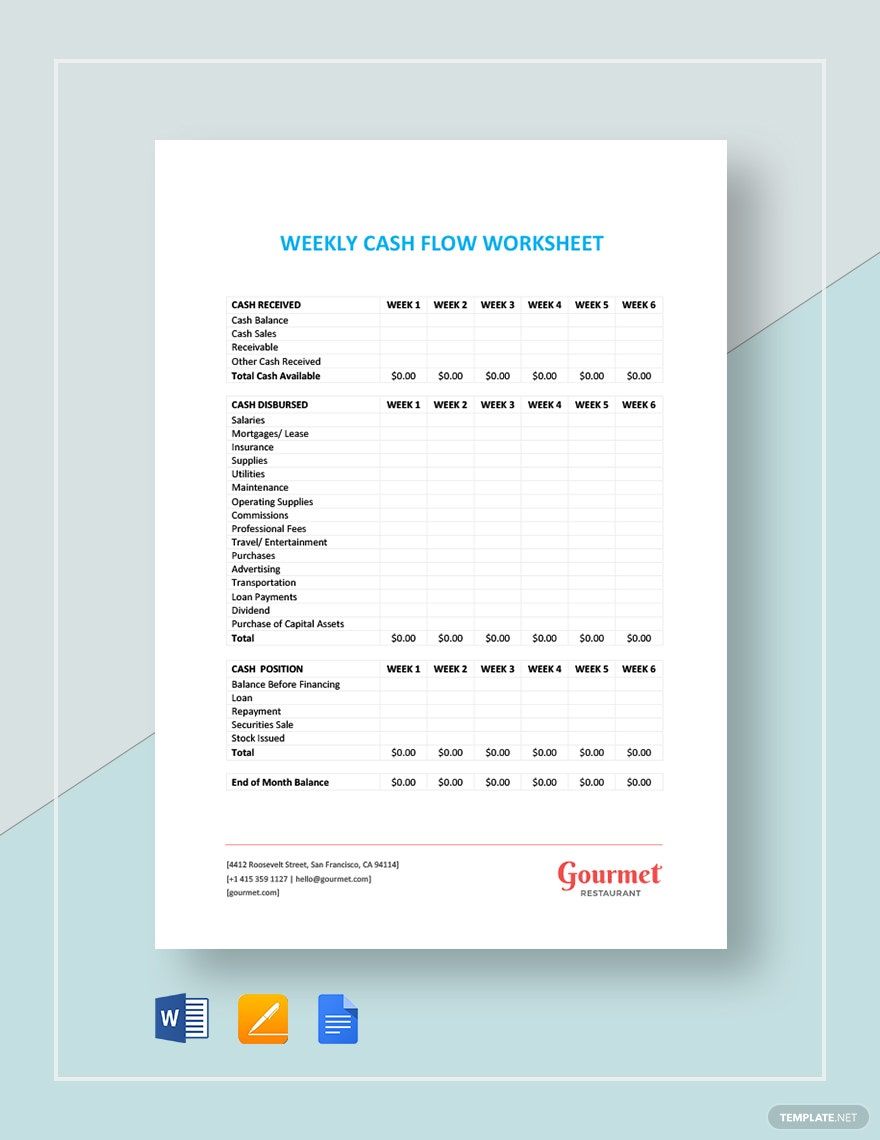

Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. These details provide an accurate picture of your company’s projected month-by-month financial liquidity. Ultimately, this template will help you identify potential issues that you must address in order for your business to remain on sound fiscal footing. Add receipts and payments to this daily cash flow template to get a deep understanding of business performance. You can customize the list of cash inflows and outflows to match your company’s operations. Use this statement of cash flows template to track and assess cash flows over a three-year period.

What is a Cash Flow Statement?

It also accounts for non-cash expense items and cash requirements alerts for maintaining the minimum required balance. Efficiently manage your business’s cash flows with the Cash Flow Analysis Template. This financial spreadsheet solution enables you to predict cash shortfalls and excesses in advance, optimizing your financial plans. By calculating your net cash flow and showing your opening and closing balance, this template provides you with a clear view of your financial health and aids in better financial planning.

Daily Cash Flow Forecast Template

- Use this daily cash flow forecast template to get a pulse on your business’ short-term liquidity.

- A cash flow sheet template is a great option for businesses to get their cash flow monitoring up and running straight away.

- Use this statement of cash flows template to track and assess cash flows over a three-year period.

- You’ll get bank details for the US, UK, euro area, Australia and New Zealand, to receive fee-free payments from these regions.

- Procrastination is the mortal enemy of nearly every financial function, from audit preparation to, you guessed it, your cash flow worksheet.

Stay on the ball throughout the year to avoid rushed work and entries that don’t lend themselves to accuracy and reliability. Likewise, be cognizant of especially complicated or large transactions on the horizon and how they might impact your cash flows. Coefficient’s Simple Cash Flow Template empowers you with the tools needed for effective financial planning and risk management.

Functions Used in the Excel Cash Flow Statement Template

A cash flow statement is a critical tool for analyzing the current liquidity of any business venture. Cash Flow Projections are even more important as they help you understand not only your current liquidity,… Read more about business cash flow, business accounting and Sheetgo’s templates in the articles below. This template covers a yearly overview of your cash flow split into months. This is great for those who are looking to simply keep track of their finances rather than an in-depth forecast of their net income.

Cash Flow Template Google Sheets Guide + 3 Free Spreadsheets

It should be customized to include the specific types of cash flow activities that apply to your company. To fill out this spreadsheet, enter the applicable values in their respective cells. An example cash flow statement is also included to help guide you through the process. Alternatively, you can easily create a cash flow statement based on an accounting system such as QuickBooks. Your company may have enough revenue to appear profitable, but slow collections of invoiced sales can impede your ability to meet your current financial obligations. Designed around the concept of discounted cash flow (DCF) valuation based on future cash flows, this template allows you to perform an analysis to determine your business’ true value.

Make sure to include line items for cash paid to employees, suppliers, and on interest. On the other hand, having too much cash or cash equivalents on hand can be a sign you’re not taking full advantage of your liquid assets. To save money in the long run, you may want to use cash to pay down high-interest debts, for example. They include cash along with liquid investments you can quickly convert into cash.

The worksheet examines the change in each balance sheet account and relates it to any cash flow statement impacts. Once each line in the balance sheet is contemplated, the ingredients of the cash flow statement will be found! Moreover, the template includes the Net Cash Flow section to provide a clear view of your business’s financial health. The Stock-Based Compensation and Common Stock Dividends Paid sections are essential for businesses that engage in such activities.

Note again that this is meant to show how much cushion your spending account has. If you want a more comprehensive workflow for your finance team, or you need help using the Google Sheets or Excel cash flow template, talk to our automation experts. This comprehensive overview makes it easy to spot trends, manage spending, and ensure the health of your finances. Whether you’re running a small business, freelancing, or managing your personal finances, this template is a must-have tool. The template primarily separates the cash flow into three categories – Operating Activities, Investing Activities, and Financing Activities. It further breaks down each activity into subsets, such as Net Income, Depreciation, Deferred Income Taxes, and others – contributing to a comprehensive financial snapshot.

The spreadsheet contains two worksheets for year-to-year and month-to-month cash flow analysis or cash flow projections. A cash flow analysis is not the same as the business budget or profit and loss projection which are based on the Income Statement. However, for a small uncomplicated business operating mainly with cash instead of credit accounts, there may seem to be little difference.

Spreadsheet-based workflow template to track payments, receipts and your cash balance. There are a variety of templates available for Google Sheets, each one has different features that meet the needs of specific business objectives. Let’s take a look at the templates available to take your cash flow management to the next sales tax and income tax level. Sage Intacct has 150 built-in financial reports enabling you to easily create custom reports and leaving you with more time to focus on your business and prepare your financial statements. IFRS requires companies to disclose cash flow from discontinued operations either in the cash flow statement or in its notes.

Use this spreadsheet-based cash flow system to combine payments and receipts data from across your company and create an automated cash flow monitor that’s always up to date. It helps you calculate your total cash upfront and the gross monthly rent you could earn from your property. It deducts all potential expenses such as property insurance, taxes, management fees, a sinking fund, and more to provide you with the net operating income. The Restaurant Cash Flow Template from Live Flow is a meticulously designed Google Sheets template that serves as a comprehensive financial guide for restaurant owners. It helps track and analyze both the income and expenses of your restaurant business. This Cash Flow Forecast Template from Live Flow has been meticulously designed to help businesses predict their cash inflows and outflows.