Each of these approaches has distinct advantages and disadvantages, but they are all used to determine the property’s fair market value. The decision rule argues that a firm should choose the project with the highest accounting rate of return when given a choice between several projects to invest in. ARR takes into account any potential yearly costs for the project, including depreciation. Depreciation is a practical accounting practice that allows the cost of a fixed asset to be dispersed or expensed. This enables the business to make money off the asset right away, even in the asset’s first year of operation. They are now looking for new investments in some new techniques to replace its current malfunctioning one.

What is a good average rate of return?

(1) Find the Average Net Income in the ARR formula by averaging all the figures on row 22, which arrives at $12.1m. Note that we divide by 2 because we are looking for the average of opening balance of assets’ book value and ending balance of assets’ book value. Read on as we take a look at the formula, what it is useful for, and give you an example of an ARR calculation in action.

Accounting Rate of Return (ARR) Definition & Formula

Of course, that doesn’t mean too much on its own, so here’s how to put that into practice and actually work out the profitability of your investments. The first limitation has to do with the lack of objective estimation of the cutoff period. Since the AAR figure is not comparable to a market return, we are unable to distinguish between profitable and unprofitable investments. We lack solid grounds for comparison, which may hinder the proper interpretation of the rate.

Finance Calculators

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- Average investment may be calculated as the sum of the beginning and ending book value of the project divided by 2.

- A positive net cash inflow also means that the rate of return is higher than the 5% discount rate.

- It basically demonstrates how much a firm must earn in order to keep its shareholders invested and its operations running.

- In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical.

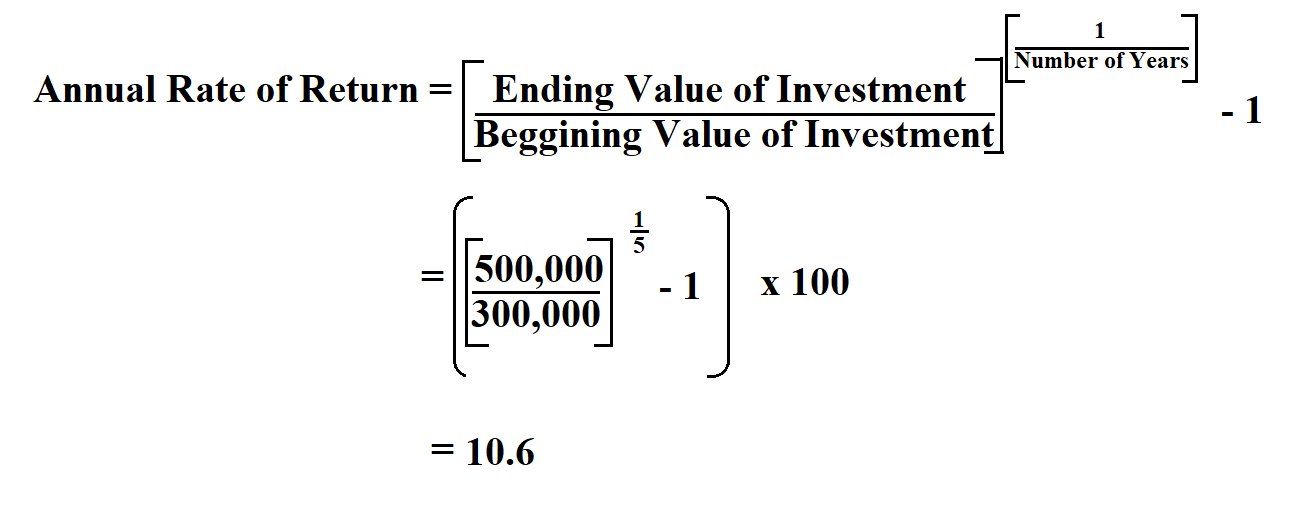

This means that the figures for cash inflows and outflows, and therefore the accounting rate of return, are inaccurate. The accounting rate of return, or ARR, is another method of investment appraisal. The accounting rate of return measures the profit generated compared to the initial investment. The accounting rate of return (ARR) is a formula that shows the percentage rate of return that is expected on an asset or investment. This is when it is compared to the initial average capital cost of the investment. The rate of return (ROR) is a simple to calculate metric that shows the net gain or loss of an investment or project over a set period of time.

Candidates should note that accounting rate of return can not only be examined within the FFM syllabus, but also the F9 syllabus. Recent FFM exam sittings have shown that candidates are struggling with the concept of the accounting rate of return and this article aims to help candidates with this topic. Along 2021 refund schedule with profits, firms are now equally concerned about the costs they have to pay on a daily basis. One of the most important aspects of Corporate Finance has to do with the Cost of Equity. It basically demonstrates how much a firm must earn in order to keep its shareholders invested and its operations running.

Assume, for example, a company is considering the purchase of a new piece of equipment for $10,000, and the firm uses a discount rate of 5%. After a $10,000 cash outflow, the equipment is used in the operations of the business and increases cash inflows by $2,000 a year for five years. The business applies present value table factors to the $10,000 outflow and to the $2,000 inflow each year for five years. Once the effect of inflation is taken into account, we call that the real rate of return (or the inflation-adjusted rate of return). The simple rate of return is considered a nominal rate of return since it does not account for the effect of inflation over time. Inflation reduces the purchasing power of money, and so $335,000 six years from now is not the same as $335,000 today.

Accounting Rate of Return helps companies see how well a project is going in terms of profitability while taking into account returns on investments over a certain period. The Accounting Rate of Return is the overall return on investment for an asset over a certain time period. It offers a solid way of measuring financial performance for different projects and investments.

An accelerated depreciation method, for instance, would have a totally different impact on the net income figures. Very often, ARR is preferred because of its ease of computation and straightforward interpretation, making it a very useful tool for business owners, key stakeholders, finance teams and investors. While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations. Accounting Rate of Return formula is used in capital budgeting projects and can be used to filter out when there are multiple projects, and only one or a few can be selected.