We have also examined how they serve as essential guides for various stakeholders, including investors, creditors, and internal management. The shareholder equity section mainly provides information about how the firm has been financed and how much profit it retains to reinvest further in the business. Items included in Shareholders’ equity are common stock, additional paid-in capital, retained earnings and accumulated other comprehensive gains/losses, etc. Fixed Assets are those long-term assets that are utilized in the current fiscal year and many years after that.

What is the Accounting Equation?

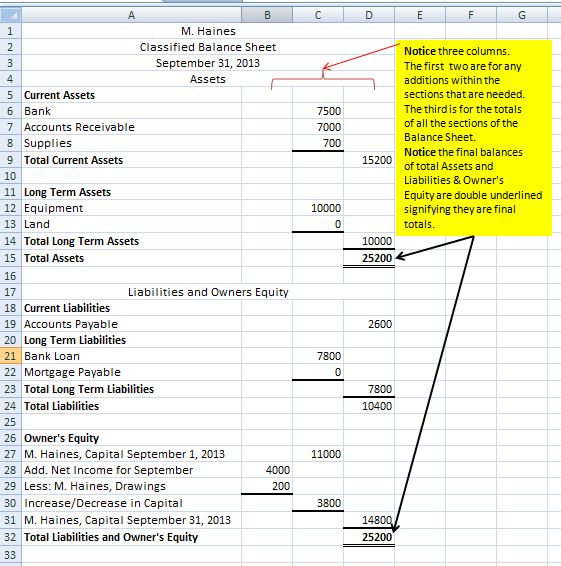

Understanding the method of preparation of this kind of balance sheet is important. It involves complex process since classified balance sheet template there is a lot of break up an details. However, let us learn the steps to prepare sample classified balance sheet.

Long Term Liabilities

The current liabilities can be of interest and non- interest bearing nature. Classifying assets and liabilities as current or non-current helps assess the company’s short-term and long-term financial health. Current items are those expected to be converted into cash or settled within one year, while non-current items are held for longer periods. A classified balance sheet helps organize and categorize a company’s financial information into relevant sections, providing a clearer picture of its financial position and aiding in financial analysis. The classified balance sheet is far from a mere financial snapshot; it is a dynamic instrument that offers invaluable insights into a company’s financial health and operational strategy. Its organized structure makes it an indispensable tool for stakeholders to assess a company’s short-term liquidity and long-term solvency, aiding in effective decision-making.

Easy To Perform Ratio Analysis

- The purpose of the classified balance sheet is to facilitate the users of financial statements.

- Learn how to format your balance sheet through examples and a downloadable template.

- Notes are used to describe accounting policies, major business events, pending lawsuits, and other facets of operation.

- There are no set criteria on how many sub-categories can be created and it will ultimately depend on what level of detail is required by the management.

- To start with, you need to recognize and enter your assets appropriately, allocating them to the right categories.

Classified balance sheets are more often used in corporate financial reporting whereas. These detailed balance sheets can be prepared in both formats of reporting, either IFRS or GAAP US. For example, an investor interested in the day-to-day operations and profitability of the firm would like to calculate the current ratio. He would have to deep dive into every section in a normal balance sheet and read notes specifically for each asset and liability.

A classified balance sheet reader can extract the exact information needed without getting overwhelmed or distracted by sophisticated information. To sum up, a classified balance sheet aims to report the company’s assets and liabilities in as detailed a manner as possible. The purpose of the classified balance sheet is to facilitate the users of financial statements. Since the balance sheet is the most used financial statement for analyzing a business’s financial health, it should be reported and presented in an easily accessible form. Current assets are liquid as they can be converted into immediately as compared to fixed assets which are not highly liquid.

Variations in Classified Balance Sheets in Different Countries – The Global Perspective

Each classification is organized in a format that can be easily understood by a reader. A classified balance sheet is important because it provides a snapshot of a company’s financial position. This information can be used by investors, creditors, and other interested parties to make informed decisions about whether to invest in or lend to the company. Each of these components provides valuable information about the company’s financial position, and understanding them is key to interpreting a classified balance sheet effectively. To create a balance sheet manually, start with two columns for entries – one for categories and subcategories and one to the left that will show total amounts. Plug-in the formula above and fill in the form with your company’s information.

In a balance sheet, he would need to profoundly plunge into each segment and read notes explicitly for each liability and asset. In any case, in a classified balance sheet format, such a computation would be direct as the administration has clearly mentioned its current assets and liabilities. This format is significant in light of the fact that it gives users more data about the organization and its activities. Investors can use these subcategories in their financial investigation of the business. For example, they can use metrics like the current ratio to survey the organization’s worth by looking at the current assets and liabilities. As we’ve seen, the implications extend far beyond domestic considerations.

Classified balance sheet is used to provide picture to insiders and outsider about the financial health of organization in classified manners. This statement breaks down all accounts into smaller categories to create a more meaningful and useful financial report (Weygandt, Kimmel, & Kieso, 2012). An unclassified balance sheet provides minimal information, only presenting totally balances for assets, liabilities, and owner’s equity.