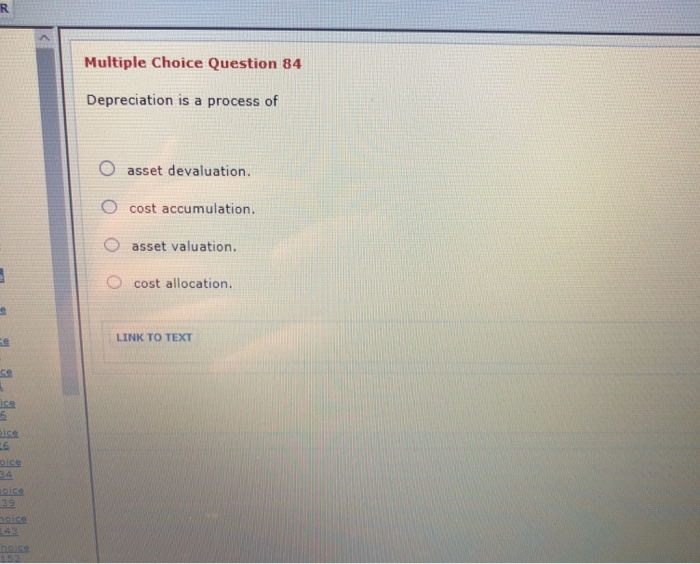

The purchase price of an asset is its cost plus all other expenses paid to acquire and prepare the asset to ensure it is ready for use. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. As this example indicates, using depreciation for tax purposes is closely tied to the aim of reducing taxable income. Noncurrent, nonmonetary assets are purchased because they represent bundles of future benefits.

Accumulated Depreciation, Carrying Value, and Salvage Value

Depreciated cost is the value of a fixed asset minus all of the accumulated depreciation that has been recorded against it. In a broader economic sense, the depreciated cost is the aggregate amount of capital that is “used up” in a given period, such as a fiscal year. The depreciated cost can be examined for trends in a company’s capital spending and how aggressive their accounting methods trial balance worksheet definition are, seen through how accurately they calculate depreciation. Sum-of-years-digits is a spent depreciation method that results in a more accelerated write-off than the straight-line method, and typically also more accelerated than the declining balance method. Under this method, the annual depreciation is determined by multiplying the depreciable cost by a schedule of fractions.

Double-declining balance depreciation

For the sake of this example, the number of hours used each year under the units of production is randomized. For example, the IRS might require that a piece of computer equipment be depreciated for five years, but if you know it will be useless in three years, you can depreciate the equipment over a shorter time. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Our team is ready to learn about your business and guide you to the right solution.

Property

A fixed asset such as software or a database might only be usable to your business for a certain period of time. A depreciation schedule is a schedule that measures the decline in the value of a fixed asset over its usable life. This helps you track where you are in the depreciation process and how much of the asset’s value remains. Understanding depreciation is important for getting the most out of your assets at tax time.

- While you’ve now learned thebasic foundationof the major available depreciation methods, there are a few special issues.

- Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two.

- In this case, a new remaining depreciation expense would be calculated based on the remaining depreciable base and estimated remaining economic life.

- The table also incorporates specified lives for certain commonly used assets (e.g., office furniture, computers, automobiles) which override the business use lives.

Streamline your accounting and save time

Cost is defined as all costs that were necessary to get the asset in place and ready for use. Internally developed intangible assets are expensed as incurred (R&D costs). In the case of intangible assets, the act of depreciation is called amortization. The sum-of-the-years’ digits (SYD) method also allows for accelerated depreciation. You start by combining all the digits of the expected life of the asset. This is a simple way to depreciate the value of an asset based on how frequently the asset is used.

Estimating Useful Life and Salvage Value

Insights on business strategy and culture, right to your inbox.Part of the business.com network. We believe everyone should be able to make financial decisions with confidence. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Therefore, after a certain period, the value of the exhausted asset will be zero. This is the case for mineral mines, oil wells, and other similar assets. Due to the continuous extraction of minerals or oil, a point comes when the mine or well is completely exhausted—nothing is left.

Those include features that add value to the property and are expected to last longer than a year. For example, let’s say the assessed real estate tax value for your property is $100,000. The assessed value of the house is $75,000, and the value of the land is $25,000. If this information isn’t readily available, you can estimate the percentage that went toward the land versus the amount that went toward the building by looking at the taxable value.

That is to say, the cost of the asset is allocated to the periods in which the enterprise receives benefits from the assets. The units of production method calculates depreciation based on the number of units produced in a particular year. The van’s book value at the beginning of the third year is $9,000, or the van’s cost minus its accumulated depreciation ($16,000). Now, multiply the van’s book value ($9,000) by 40% to get a $3,600 depreciation expense in the third year.

Further, they have an impact on earnings if the asset is ever sold, either for a gain or a loss when compared to its book value. Depreciation is how an asset’s book value is “used up” as it helps to generate revenue. In the case of the semi-trailer, such uses could be delivering goods to customers or transporting goods between warehouses and the manufacturing facility or retail outlets.