Unlike direct costs, which can be easily traced to specific departments, shared service costs are more diffuse. Organizations often employ various allocation bases, such as the number of employees, the volume of transactions, or the level of service usage, to distribute these costs. For instance, the costs of an IT helpdesk might be allocated based on the number of support tickets raised by each department.

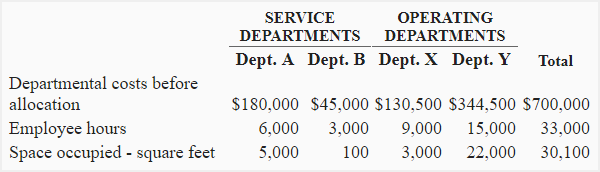

1: Allocation of Service Department Costs

Examples of service departments are human resources, accounting, information technology and custodial services. Activity-Based Costing (ABC) represents a significant evolution in cost allocation methods, particularly suited for organizations with diverse and complex operations. Unlike traditional methods that may allocate costs based on simplistic metrics like direct labor hours or machine hours, ABC delves deeper into the specific activities that drive costs. By identifying and analyzing these activities, organizations can achieve a more precise allocation of overhead costs, leading to more accurate product costing and profitability analysis.

Calculating Fully Reciprocated Costs

In addition, the inventory values are acceptable from the financial reporting perspective. Thus, from these two perspectives, thismethod is better than the other three. The allocations based on sales values at the split-off point (See Exhibit 6-17) are more acceptable from both the financial reporting and decision perspectives. The allocationscreate equal profit ratios for both products, which insures that the resulting inventory values for both products are below their market values.6This result will not create any special problems for accounting. From the management decision perspective, these results are not useful, but at least theydo not support an incorrect decision with regard to product D.

The Company

Examples of service departments are maintenance, administration, cafeterias, laundries, and receiving. Service departments aid multiple production departments at the same time, and accountants must allocate and account for all of these costs. It is crucial that these service department costs be allocated to the operating departments so that the costs of conducting business in the operating departments are clearly and accurately reflected. Departmental rates based on machine hours would provide accurate product costs.b.

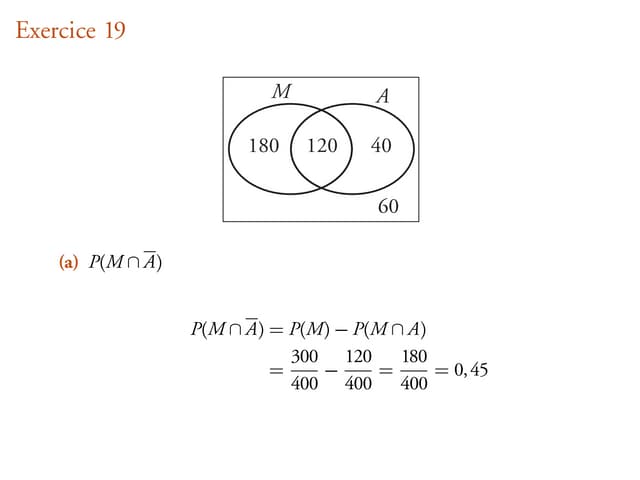

How is the sequence of the service departmental cost allocations determined in the step-down method? Fully reciprocated custodial services costs to be allocated to production departments, as calculated above, equal $90,679. The assembly department allocation equals 71 percent of $90,679, which is $64,382. The painting department allocation equals 19 percent of $90,679, which is $17,229. Fully reciprocated human resources costs to be allocated to production departments, as calculated above, equal $159,068. The assembly department allocation equals 67 percent of $159,068, which is $106,575.

- After the simultaneous equations have been solved, the allocations to the producing departments are easily determined by hand as follows.

- Allocate the service department costs to both service departments and producing departments based on the allocation proportions provided in Table 1.

- The underlying concepts of cost allocations relate to the purposes of assigning costs to cost objects as well as the principles, or supporting logic for the cost allocation methods chosen.

- Discuss the cost distortions that tend to occur when a plant wide overhead rate is used.10.

- The ABC method begins by identifying the key activities within an organization that consume resources.

- Advanced software solutions, such as enterprise resource planning (ERP) systems, offer robust tools for tracking and allocating costs.

The reciprocal service to C is ignored as, by now, it is not material. However, if we choose to fully reflect the reciprocal services between C and D, one of two methods are possible – the repeated distribution approach or the algebraic approach. Both are methods of solving a simultaneous equation and should give the same result. In the exam, the examiner will indicate that he wants you to use one or either of these methods by asking for a method that ‘fully reflects the reciprocal services involved’.

The plant wide rates provide inaccurate product costs because the products do not consume the indirect resources in the same proportions in each of the two departments. The step-down, or sequential method, ignores self services, but allows for a partial recognition of reciprocal services. As a result, the step-down method is different from thedirect method in that some service department costs are allocated to other service departments. Equations forthe service departments [1] are developed to allocate the service department costs in sequence starting with the department that serves the greatest numberof other service departments. An alternative approach is to start with the service department that provides the highest percentage of its’ service toother service departments. In determining the sequence of allocations, ties can be broken by using the alternative approach.

Cost allocations are needed to value inventory for external reporting purposes, for planning and monitoring thecost of activities and processes, and for various short term and long term strategic decisions. In addition,since cost allocation methods are components of the overall performance evaluation system, cost allocations tend to influence the behavior of theparticipants within the system. Therefore, system designers must also carefully consider the motivational, or behavioral aspects of alternative cost allocationmethods. Allocate the service department costs to both service departments and producing departments based on the allocation proportions provided in Table 1. Show the allocations from each service department to each service and producing department, including self-service and the costs after all allocations have been made.

Using the data above, fully reciprocated human resources costs equal $150,000 + (fully reciprocated custodial services costs x 10 percent). Fully reciprocated custodial services costs equal $70,000 + (fully reciprocated human resources costs x 13 percent). Using paid family leave this information, FRHRC and FRCSC can be calculated algebraically. The custodial services department allocates its costs based on square footage. Assembly occupies 3,000 square feet, accounting for 71 percent of the square footage used to allocate costs.

The idea is to allocate the cost to whatever causes, or drives the cost. If the driver for a cost cannot beidentified, or identified easily, then an allocation scheme perceived to be “fair and equitable” might be used. A search for a “fair andequitable” allocation method often leads the system designer to the “ability to bear” the cost logic. Some examples that most readers canrelate to include allocating the costs of federal, state and local governments to their constituents. Federal and state income taxes are based on the”ability to bear” logic, i.e., they are progressive in that those with higher incomes pay a higher percentage of their incomes than those with lowerincomes.

This means service department costs are allocated to and from the other service departments. The final method, is the reciprocal method.Although it is the most accurate, it is also the most complicated.In the reciprocal method, the relationship between the servicedepartments is recognized. This means service department costs areallocated to and from the other service departments. Reciprocal allocation is the most comprehensive and complex method, as it fully recognizes the mutual services provided among departments.